Navigating GST Refunds: A Comprehensive Step-by-Step Guide

Introduction: Overview of the GST refund process. Explanation of the types of refunds available: excess cash balance, tax paid by...

Read more“Maharashtra: GST & Consumption Leader”

Here's a detailed summary of the provided information: Maharashtra's Contribution to GST Collection: Maharashtra leads India in Goods and Services...

Read moreAditya Vision Faces GST Search Operations: Impact and Response

Here's a breakdown of the detailed information and important points regarding the GST search operations conducted at Aditya Vision: Search...

Read moreUnderstanding GST Exemptions for Goods

Understanding the taxability under the Goods and Services Tax (GST) regime involves comprehensive knowledge of exemptions granted by the government....

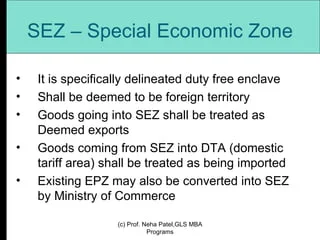

Read more“GST & E-Way Bills in SEZs”

As every person is affected by the implications of GST and e-way bill, Special economic zones (SEZ) too have been...

Read more“GST: Debit Note, Credit Note, and Revised Invoice”

Credit Notes: Credit notes are documents issued by registered persons under section 34(1) of the CGST Act 2017 in various...

Read moreApplicability and Procedure for Paying Additional Tax

What is Form DRC-03? Discover the essentials of DRC-03, a form under GST law utilized for voluntary tax payments addressing...

Read moreA Step-by-Step Guide to Claiming Your GST Refund

Steps to Submit a Refund Pre-application Form To initiate the GST refund process, taxpayers must follow these steps to fill...

Read moreUnderstanding Reverse Charge Mechanism (RCM) under GST

Reverse charge is a mechanism where the recipient of the goods or services is liable to pay Goods and Services...

Read moreSimplifying GST Registration in India with Virtual Office Solutions

In India, acquiring GST registration necessitates a registered business address, which can pose challenges, especially for small and medium enterprises....

Read more