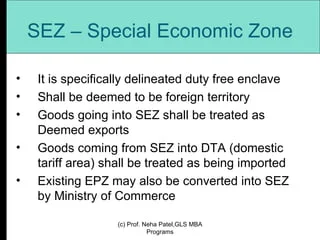

As every person is affected by the implications of GST and e-way bill, Special economic zones (SEZ) too have been impacted. This article explores GST and e-way bill rules applicable for SEZ. Meaning of Special Economic Zone (SEZ) A Special Economic Zone (SEZ) is a dedicated zone wherein businesses enjoy simpler tax and easier legal compliances. SEZs are located within a country’s national borders. However, they are treated as a foreign territory for tax purposes. This is why the supply from and to special economic zones have a little different treatment than the regular supplies. In simple words, even when SEZs are located in the same country, they are considered to be located in a foreign territory. SEZs are not considered as a part of India. Based on this, it can be clearly said that under GST, any supply to or by a Special Economic Zone developer or Special Economic Zone unit is considered to be an interstate supply and Integrated Goods and Service tax (IGST) will be applicable. Meaning of Export/ Import The SEZ’s are considered to be located in a foreign territory and thus the transactions with SEZ’s can be classified as exports and imports. Export means: Taking goods or services out of India from a special economic zone by any mode of transport or Supply of goods or services from one unit/developer in the SEZ to another unit in the same SEZ or another SEZ. Import means: Bringing goods or services into a special economic zone from a place located outside India, by any mode of transport or Receiving goods or services from one unit/developer in the SEZ by another unit/developer located in the same SEZ or another SEZ. GST Laws on SEZ Being in a SEZ can be advantageous to a certain extent when it comes to taxes. Any supply of goods or services or both to a Special Economic Zone developer/unit will be considered to be a zero-rated supply. That means these supplies attract Zero tax rate under GST. In other words, supplies into SEZ are exempt from GST and are considered as exports. Therefore, the suppliers supplying goods to SEZs can: Supply under bond or LUT without payment of IGST and claim credit of ITC; or Supply on payment of IGST and claim refund of taxes paid. When a SEZ supplies goods or services or both to any one, it will be considered to be a regular inter-state supply and will attract IGST. The exception to this is, when a SEZ supplies goods or services or both to a Domestic Tariff Area (DTA), this will be considered as an export to DTA (which is exempt for the SEZ) and customs duties and other Import duties will be payable by the person receiving these supplies in DTA. e-Way Bill Rules for SEZ Under GST, transporters should carry an e-way bill when moving goods from one place to another if the value of these goods are more than Rs.50,000. SEZ supplies are treated how the other inter-state supplies are treated. The SEZ units or developers will have to follow the same EWB procedures as the others in the same industry follow. In case of supplies from SEZ to a DTA or any other place, the registered person who facilitates the movement of goods shall be responsible for the generation of e-way bills. Let’s understand this with an example: XYZ is and unit in an SEZ located in Karnataka A is the recipient of goods manufactured by the SEZ and is located in Bangalore. The value of the goods being transported this time is Rs.75,000.

- Home

- Today News

- GST

- Income Tax

- Company Law

- Custom & Excise

- Finance

- Registrations

- Business Ideas

- Franchise

- Startup

- Contact Us

- Home

- Today News

- GST

- Income Tax

- Company Law

- Custom & Excise

- Finance

- Registrations

- Business Ideas

- Franchise

- Startup

- Contact Us

“GST & E-Way Bills in SEZs”

Exploring Tax Implications and Compliance Procedures in SEZs

153

SHARES

1.9k

VIEWS

- Trending

- Comments

- Latest

Understanding GST Exemptions for Goods

April 3, 2024